Purchasing items online or paying for a service using local bank debit cards in Nigeria especially when the payment is in dollars, can be incredibly challenging. This issue has affected many internet users in the country, I will share methods to acquire International Bank Accounts and Debit Cards that allow Nigerians to make online purchases from foreign countries.

The Central Bank of Nigeria (CBN) has imposed a ban on online purchases made by Nigerians. This has led to the existence of black markets and official bank rates in the country.

Currently, the value of one dollar is approximately ₦745 on the black market and around ₦490 in official banks. This substantial difference of nearly ₦300 in dollar value has raised concerns for the CBN. They believe that individuals using Naira to make foreign online purchases are primarily seeking to profit from exchanging Naira for dollars. As a result, they have imposed restrictions, allowing only a few Naira cards to have a monthly spending limit of $20, and most Naira cards have been barred from making foreign payments.

For Nigerians, especially those working online, it is essential to be able to buy items from platforms like Amazon or AliExpress, pay for online advertisements as affiliate marketers, and cover expenses like software, domain names, and website hosting, all of which require transactions in dollars. So, what is the best way to address this challenge currently?

Both actual and digital debit cards are available. Although a virtual debit card isn’t necessarily required to have a physical account number, it may need to have internet access to international bank accounts and card information. These accounts are typically in dollars, euros, or pounds sterling. Then you can use that to make any online purchases.

So that you may use any of them to make online purchases, let me demonstrate a few platforms that provide actual and virtual debit cards as well as international bank accounts.

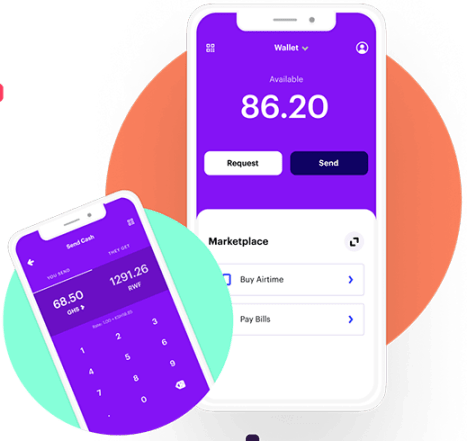

1. Chipper Cash USD Virtual Debit Card

Chipper Cash has been around for a long and is well-known to many blog readers. The Chipper virtual USD Card is only available if you have a Chipper Naira account.

More information about setting up a Chipper Cash account may be found here. If you have already done so, you can proceed to the instructions for activating your Chipper virtual USD Debit Card.

Steps to Activate Chipper USD Virtual Debit Card:

- Open the Chipper Cash app and log in to your verified account.

- Add Naira to your Chipper wallet by tapping on the “Add Cash” icon on the app’s home screen.

- Your Personal Chipper Account number will be displayed; send the money from your local bank to your Chipper Wallet using this account number.

- After loading your wallet, go to the “Card” icon in the Chipper app and select “Claim Card.”

- Provide the necessary information and tap “Looks Good!” when finished.

- Tap “Continue,” and your Chipper USD Virtual Debit Card will be ready for use.

Keep in mind that Chipper allows you to create both NGN virtual debit cards and US debit cards, so be sure to select the correct card according to your needs.

2. Flip by Fluid Coin USDT Virtual Debit Card

Fluid coins offer an app called “Flip by Fluid Coins,” which operates by funding your virtual debit card with USDT, a stablecoin that has an equivalent value to the US Dollar.

With Flip’s reliable virtual card, you have the freedom to make online payments conveniently. Whether you are enrolling in courses on Coursera or making purchases on platforms like Amazon, AliExpress, or Asos, the virtual card ensures seamless transactions.

How to create a Flip USDT virtual debit card

- Download the Flip app for your Android or iOS device here.

- Install and launch the app on your phone.

- After opening the app, if you are using an iPhone, it will prompt you to proceed with your Apple account, while Android users will be asked to continue with their Google account. The app will be saved accordingly for your convenience.

- To set up your profile and verify the account, click on the “Account” icon. To upgrade your account to Tier 2, complete your KYC process, which involves BVN verification and submitting valid identification such as NIN, Voter’s Card, Driver’s License, or international passport.

- Once your verification is complete, you can proceed to create a Visa card that will facilitate online payments. To fund your Flip wallet, you can transfer funds from your Nigerian bank account.

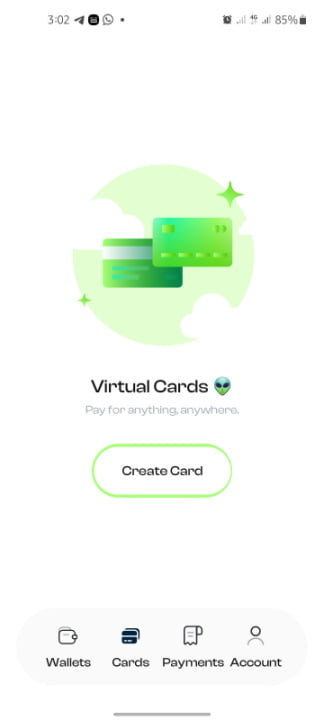

- Navigate to the Cards section within the app and click on the “Create Card” icon to initiate the card creation process.

To get started, create a virtual card by funding your wallet with a minimum of $10 and paying a one-time fee of N1,000.

Congratulations! You now have an International Bank Account and Virtual Debit Card backed by USDT, complete with your name, card number, security code, and zip code.

You have the flexibility to create a single card for all your payments or opt for different cards for various websites, such as one for Amazon payments, another for AliExpress, and more.

The best part is that verifying your account takes less than 5 minutes, enabling you to start making payments on any online platform right away.

It’s essential to note that while these cards offer great convenience, not all websites accept them, so exercise caution when making purchases. While Gray debit cards, Chipper virtual USD Debit Cards, and Flip USDT virtual debit cards open up numerous possibilities, some sites may not support them.

However, you can still enjoy unlimited purchasing options using the following trio of payment methods, two of which are physical cards issued by Nigerian banks: UBA Prepaid Dollar Card, GTBank Prepaid Dollar Card, and a PayPal account. Obtaining these cards is a straightforward process, and I’ll explain how to get them quickly so you can enjoy their benefits.

3. GTBank Prepaid Dollar Card

A global payment card, the GTBank Prepaid Dollar Debit Card is issued in collaboration with MasterCard Worldwide or VISA International.

Customers of GTBank and non-customers can get the card right away to meet all of their different payment demands.

To open a GTBank Prepaid Dollar account. It’s also easy, below are the requirements:

- Non-Account Holders

- Completed Application form

- One recent passport photograph

- A recent utility bill

- A copy of your Driver’s License or International Passport

- Issuance fee of N1,000

- Annual Maintenance fee of $10 (or its equivalent in dollars)

If you have a dollar card, you can use it to make whatever online purchase you want without any restrictions. But I also utilize another method to make internet purchases. The method is PayPal.

4. UBA Prepaid Dollar Card

To obtain a UBA prepaid card, simply visit any United Bank of Africa (UBA) branch in your area. It is not mandatory to hold an account with them, but if you wish, you can open a savings or current account. However, having an account is not a requirement for obtaining a prepaid card.

UBA provides two distinct types of prepaid cards: the Naira prepaid card and the Dollar prepaid card.

Inform the bank that you wish to acquire a dollar prepaid debit card, and they will provide you with the necessary forms to complete. Before visiting the bank, ensure you bring your identification, which can be your driver’s license, international passport, voter’s card, or national ID card, even if it’s temporary.

Additionally, you’ll need proof of residence, such as a NEPA bill with your address. To activate the account, a physical deposit of $10 in cash is required at the bank counter.

Once the process is completed, you’ll have an International Bank Account along with a physical debit card. This card can be used for international online transactions. However, keep in mind that for each transaction, you’ll need to deposit the dollar equivalent into your bank account. This can be done by transferring money from your PayPal account or withdrawing from your domiciliary account and depositing it back into the UBA bank.

The dollar prepaid card allows you to make online transactions with no limits, enabling you to spend up to $10,000 per day. It can be used for various purposes, such as purchasing domain names, paying for web hosting, online ads, shopping online, and other online tools.

Alternatively, there’s another option available – the GTBank Prepaid Dollar Card, which offers a similar convenience.

5. Grey.co

If you’ve been looking for a way to receive money from outside, Grey International Bank Account, formerly known as Aboki Africa, can fill the gap because it enables you to set up a virtual International Bank Account that can contain dollars, pound sterling, and euros.

Grey makes it simple for you to easily convert foreign currency to Naira after receiving it. It’s simple to utilize their virtual debit card to make real purchases online, send money to your bank account, or move USD directly to your domiciliary account.

How to Register for a Grey Account

You can register a Grey account in a minute and receive money from abroad if you’re a Nigerian. You only need your docs (Government-issued IDs and your utility bill) to complete the verification process.

- To create a Virtual International Bank Account, download the Grey app by clicking this link.

- Open the app and select “Get Started,”

- On the registration screen, complete the necessary fields, double-check your entry, and then select Create your account.

- An email will be sent to you asking you to confirm it. After you’ve successfully validated your email, you’ll need to finish your KYC in order to verify your newly created account.

After that, you can create a Grey Virtual Account and apply for Virtual Debit Card.

How to Create a Grey Virtual Debit Card

Are you set to obtain a Grey virtual debit card? Just adhere to the instructions below;

- Login to your Grey account.

- Tap the “virtual cards” button.

- Tap “create card” under the section.

- Follow the rest on-screen instructions to obtain your card.