In a country like Nigeria, conducting online transactions, especially when dealing in foreign currencies like dollars, can pose significant challenges. Many Nigerians, including our online community, have faced this issue. This article aims to offer a solution – a comprehensive guide on obtaining International Bank Accounts and Debit Cards that empower Nigerians to make online purchases from around the world with ease.

Nigeria’s online shoppers grapple with unique challenges due to regulations imposed by the Central Bank of Nigeria (CBN). The country operates dual exchange markets with differing rates. As of October 20, 2023, the black market exchange rate for the dollar to Naira ranges from ₦1,130 to ₦1,175, averaging ₦1,160, according to ngnrates.com. In contrast, the official bank rate stands at approximately ₦765, creating a significant gap of nearly ₦410 per dollar.

The CBN’s concern revolves around the perception that individuals using Naira for foreign transactions are primarily motivated by profiting from currency exchange. Consequently, they initially imposed restrictions on Naira cards, limiting monthly foreign expenditures to just $20 and eventually banning Naira cards for international payments altogether.

Table of Contents

6 International Bank Accounts and Debit Cards for Nigerians

There are both physical and virtual debit cards available. A virtual debit card doesn’t necessarily have a physical account number but requires International Bank Accounts and online card details, mostly denominated in dollars, euros, or pounds sterling. You can then use these cards to make online purchases.

Let’s explore some platforms that provide International Bank Accounts, physical and virtual debit cards for Nigerians to utilize when making online transactions.

1. Grey.co

Grey International Bank Account, formerly known as Aboki Africa, can fill this void. It enables you to set up a virtual International Bank Account that can hold dollars, pound sterling, and euros. With Grey, you can receive money from abroad and easily convert it to Naira. You can transfer USD directly to your domiciliary account, send money to your bank account, or use their virtual debit card to make online purchases.

How to Register for a Grey Account:

- Download the Grey app.

- Open the app and select “Get Started.”

- Complete the necessary registration fields.

- Confirm your email.

- Finish your KYC to verify your account.

How to Create a Grey Virtual Debit Card:

- Login to your Grey account.

- Click on the “virtual cards” button.

- Select “create card” and follow the on-screen instructions.

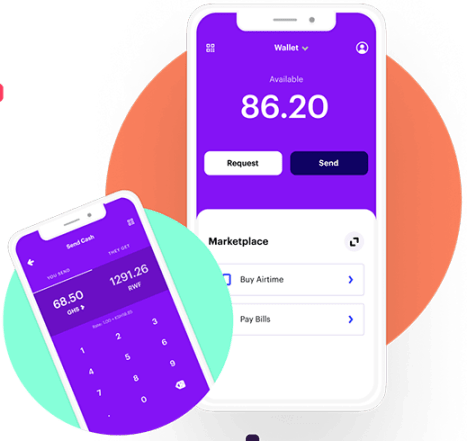

2. Chipper Cash USD Virtual Debit Card

Chipper Cash has been around for a long and is well-known to many blog readers. The Chipper virtual USD Card is only available if you have a Chipper Naira account.

More information about setting up a Chipper Cash account may be found here. If you have already done so, you can proceed to the instructions for activating your Chipper virtual USD Debit Card.

Steps to Activate Chipper USD Virtual Debit Card:

- Open the Chipper Cash app and log in to your verified account.

- Add Naira to your Chipper wallet by tapping on the “Add Cash” icon on the app’s home screen.

- Your Personal Chipper Account number will be displayed; send the money from your local bank to your Chipper Wallet using this account number.

- After loading your wallet, go to the “Card” icon in the Chipper app and select “Claim Card.”

- Provide the necessary information and tap “Looks Good!” when finished.

- Tap “Continue,” and your Chipper USD Virtual Debit Card will be ready for use.

Keep in mind that Chipper allows you to create both NGN virtual debit cards and US debit cards, so be sure to select the correct card according to your needs.

3. Flip by Fluid Coin USDT Virtual Debit Card

Flip by Fluid Coin offers a virtual debit card funded with USDT, a stablecoin equivalent to the US Dollar. This card is suitable for making online payments on platforms like Coursera, Amazon, AliExpress, and Asos.

How to Create a Flip USDT Virtual Debit Card:

- Download the Flip app for your device.

- Install and launch the app.

- Set up a profile, complete your KYC, and verify your account.

- Fund your Flip wallet through your Nigerian bank.

- Create a virtual card by following the app’s instructions.

Note: While these virtual debit cards work for most websites, some platforms may not accept them.

To ensure unlimited online purchases, we’ll explore three other payment methods, two of which are physical cards issued by Nigerian banks: UBA Prepaid Dollar Card, GTBank Prepaid Dollar Card, and PayPal account.

4. UBA Prepaid Dollar Card

To obtain a UBA Prepaid Dollar Card, visit a UBA branch and follow the application process. This card allows you to make international online transactions, but you must deposit the dollar equivalent into your bank for each transaction.

Additionally, you’ll need proof of residence, such as a NEPA bill with your address. To activate the account, a physical deposit of $10 in cash is required at the bank counter.

Once the process is completed, you’ll have an International Bank Account along with a physical debit card. This card can be used for international online transactions. However, keep in mind that for each transaction, you’ll need to deposit the dollar equivalent into your bank account. This can be done by transferring money from your PayPal account or withdrawing from your domiciliary account and depositing it back into the UBA bank.

The dollar prepaid card allows you to make online transactions with no limits, enabling you to spend up to $10,000 per day. It can be used for various purposes, such as purchasing domain names, paying for web hosting, online ads, shopping online, and other online tools.

5. GTBank Prepaid Dollar Card

GTBank Prepaid Dollar Debit Card, issued in collaboration with MasterCard Worldwide or VISA International, is accessible to both GTBank customers and non-customers. You can use this card for unrestricted online purchases.

6. PayPal Account

Although registering a PayPal account for sending and receiving money in Nigeria is not officially supported, some methods can help you set up international PayPal accounts.

In conclusion, these International Bank Accounts and Debit Cards provide a pathway for Nigerians to navigate the challenges of online international payments. While not all websites may accept virtual debit cards, the options mentioned here empower Nigerians to make online transactions more seamlessly.

Note: The availability and functionality of these services may change over time, so it’s essential to verify the latest requirements and offerings.