Discover the best virtual dollar cards tailored for Nigerian residents, enabling hassle-free international transactions on popular platforms like AliExpress, Netflix, and more.

In 2024, Nigerian consumers encounter numerous obstacles when conducting transactions on international platforms like AliExpress, Amazon, and Netflix. Banking restrictions imposed by Nigerian financial institutions, coupled with the reluctance of international payment systems to accept Nigerian bank cards, create significant hurdles. Additionally, the multi-step verification processes demanded by international merchants further complicate the purchasing experience.

However, several services offer effective solutions to these challenges through the provision of virtual dollar cards, some of which require minimal KYC procedures. Below, we present the top 5 virtual cards facilitating access to international services and purchases for Nigerian residents:

Contents

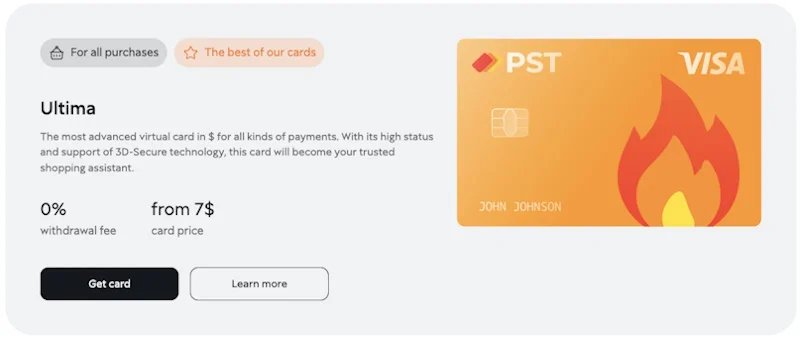

1. PSTNET Virtual Dollar Cards:

PSTNET is a financial platform offering virtual multi-currency cards, notably the popular Ultima card, for seamless international transactions. These virtual dollar cards, issued by American banks, empower users with unlimited purchasing capabilities across various international platforms, including PayPal, Netflix, and Google Play. Notable features include zero transaction fees, low reload fees, and no spending limits. PSTNET cards support secure transactions via cryptocurrencies and offer convenient notifications through a dedicated Telegram bot.

2. Chipper Cards:

Chipper Cash offers virtual cards tailored for online shopping and international transactions. Compatible with popular services like Netflix and AliExpress, these cards boast minimal commission charges and straightforward usage. While they come with daily and monthly spending limits, users appreciate the efficient technical support provided by the platform.

3. ALAT Cards:

ALAT, Wema Bank’s digital platform, provides international transaction solutions through its range of Classic, Gold, and Platinum cards. These cards facilitate online purchases and subscriptions, with spending limits and currency conversion based on the bank’s exchange rates. Users can monitor and adjust their spending limits via the ALAT app or website, ensuring flexibility and control over transactions.

4 Barter Cards:

Flutterwave’s Dollar Barter Cards streamline global transactions, allowing users to create virtual cards within minutes for specific purchases or payments. Despite concerns about future service continuity, the platform offers flexibility in customizing cards and supports seamless money transfers worldwide.

5 Kuda Cards:

Kuda Technologies delivers virtual Visa cards suitable for international purchases, including subscriptions to streaming platforms like Netflix and Spotify. With options for fee-free cards and a convenient loan program, Kuda caters to diverse financial needs. However, users should be mindful of spending limits and deposit requirements associated with the service.

These virtual dollar cards offer Nigerian residents convenient solutions for international transactions, each with its unique advantages. By considering individual preferences and requirements, users can select the most suitable virtual card to enhance their purchasing experience on global platforms.